I’ve spent most of my career building technology that simplifies people’s lives. But Trusty didn’t begin as a business idea. It began with a small moment in my own home, one that I think many families can relate to.

A couple years ago, I bought a piece of jewelry for my wife. It came with the usual appraisal documents, and I did what most people do: I slid them into our “important documents” drawer. They landed right beside my will. And that’s when it hit me—my will didn’t mention any of the assets that mattered most to me. Not this piece of jewelry, not other valuables, not the sentimental things with real meaning.

When I asked lawyers why these details weren’t included in my will, they explained that a will is a legal document; personal direction around treasured belongings, family guidance, and broader wishes are meant to live separately in “Letters of Wishes”. At the time, I didn’t even know what a Letter of Wishes was even though I just updated my Will that year.

But to me, those missing pieces felt like some of the most important matters. I got overwhelmed thinking what if my family had to piece this all together. But I didn’t know where to start - so I didn’t.

Then it became real - loss put things in perspective

Just a few months later my grandmother passed away at 104. My family and I found ourselves facing a different set of challenges, ones that had nothing to do with the specific financial parts of her will. It was the fears I’d found in that drawer just a few months earlier: who would receive the personal, meaningful things? The treasured items that carried her story, her humour, her elegance—pieces we wanted to hold onto as reminders of who she was from art to handbags and even the gong that called everyone to dinner.

In our case, we were lucky. Our family is loving, and at times almost too polite. Instead of fighting, we tiptoed around decisions moving yellow sticky notes with names from one heirloom to the next, unintentionally creating frustration for the executors. But as I started speaking to more families, I learned that this is where many people struggle the most—not with the legal documents, but with the things that aren’t defined.

And it wasn’t just valuables. We found heartfelt, handwritten notes—guidance for how she hoped we’d support each other after she was gone. Those notes rallied us. They drew us closer, helped us understand her intentions, and brought a sense of unity at a time when emotions easily could have pushed people apart.

That experience crystallized something for me: legacy isn’t just about what you leave behind—it’s about the clarity, comfort, and connection you leave your family with.

That moment set me down the path of building Trusty—not just to organize assets and documents, but to give families a better way to capture the wishes, context, and clarity that sit between life and legacy.

When I finally dug into estate planning, the gaps became obvious and who got heirlooms was just one

I started researching how families, particularly those with more complex estates, keep track of their wishes, their documents, and the legacy they hope to leave behind. It became clear that even the most organized individuals and their advisors face similar challenges: the information was scattered.

- A Will covers only a fraction of what families need to know about how to pass on wishes, plans, and assets.

- Wealth managers track financial accounts, but not household, personal, or practical information.

- Medical directives are created but not always clearly shared.

- Executor roles are defined legally, but rarely supported operationally.

- Insurance information exists, but often no one knows what policies cover, or if there are risky gaps in coverage.

- Updates happen but live in email threads, handwritten notes, and updated PDFs no one distributes.

Every expert handles a piece of the puzzle, but no one connects the dots.

The result? A burden for families during the most difficult moments of their lives, and unnecessary, often costly, risk for individuals who believe they’ve already “taken care of everything.”

The insight that shaped Trusty

Estate planning is not as simple as “do you have as Will?” or a set of documents. It’s a living ecosystem of information, decisions, and intentions — financial, personal, emotional, and practical.

And that ecosystem breaks down without:

- A simple way to keep information centralized and updated

- A way to share the right pieces with the right people at the right time

- A bridge between families and the advisors who support them

No platform existed to do this in a way that felt intuitive, modern, secure, and accessible to both families and professionals.

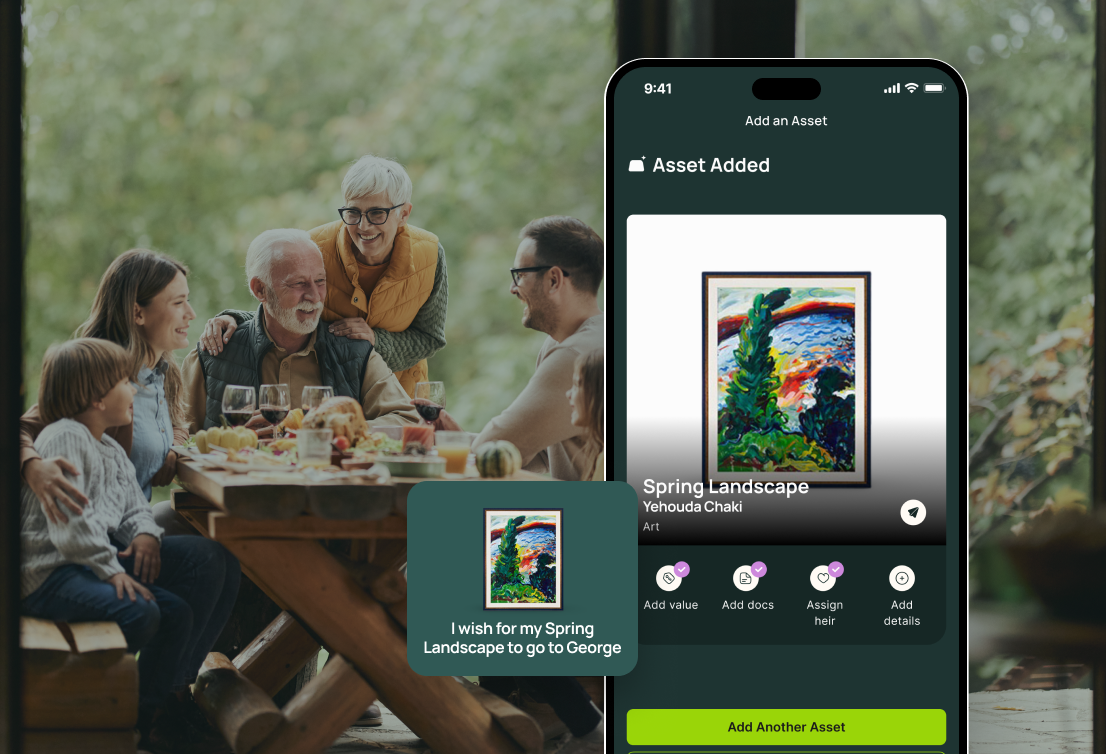

So we built it. One secure Estate Binder where everything lives.

Trusty’s mission is simple: clarity for families, confidence for advisors

Trusty exists to make estate and legacy management seamless, and to do it long before families find themselves in crisis.

For families, it means:

- One trusted home for estate documents, plans, accounts, insurance, key contact details, and personal wishes

- A place to record personal intentions and stories behind meaningful possessions

- The comfort of knowing loved ones will know where to find what they need when it’s needed most

For advisors, it means:

- A clear, organized view of the families and households you support

- Fewer gaps and blind spots in planning, because you finally see a full picture of wealth

- The ability to deepen relationships across generations, a gap in many trusted advisors business today

- A tool that strengthens, not replaces, their role

For investors, it means addressing one of the largest, most emotionally charged, least-modernized categories in financial services: wealth transfer and family legacy.

This isn’t about death. It’s about connection.

When we landed on the term Estate Binder we decided not to lean to the click-bait options like Death Binder. Trusty is not a product born from fear. It’s born from care; care for the people who matter, for the legacies we build over a lifetime, and for the stories that deserve to be carried forward.

We’re building Trusty because families deserve clarity. We’re building for Advisors who want to help families and bridge relationships into the next generation. That next generation deserves more than documents, they deserve the meaning behind them.

The definition of a trustee is one who manages and ultimately distributes assets to one or more beneficiaries. If we can make moments a little easier, a little clearer, and a lot more connected, then we’re delivering on our promise.

Partner with Trusty

Connect with our partnership team to learn how Trusty can enhance your services and bring peace of mind to those you serve.

.avif)

.png)